I’ve spoken on our podcast Define Your Exit Podcast about the importance of a proper P&L (profit & loss report) in the past but wanted to give more context to the conversation. It’s not a hot or sexy topic to some, but a proper P&L is a pillar to the foundation of your business.

This article will help you understand accrual P&L vs cash basis P&L and why accrual based P&L is better for a physical products company on amazon.

If you run a business that sells physical products on amazon, then understanding the difference between accrual based P&L vs cash basis P&L is critical to your business. Even if you never want to sell, (we’ll get into why later). There are many reasons that accrual based statements are better but there are two main ones:

1) it’s not possible to manipulate the timing of transactions in accrual accounting.

2) it provides transparency by requiring an entity to recognize revenue when earned.

Now why are these two points important when selling your business? If someone is looking to buy your business, you need to pull back the curtains and show them you have a stable and profitable business, also known as preliminary due diligence. Think of this similar to an open house for your home you want to sell. A preliminary view into what someone wants to buy. No one is making an offer before looking at the house (typically) and no one is bringing an inspector to the open house either. Most businesses looking to buy your business require looking at the books (P&L) before they make an offer.

Now let’s look at the two types of P&Ls.

Cash vs. Accrual Accounting

A cash based P&L is very simple. It’s a company’s sales minus expenses, typically measured every month.

Example: You generated $100,000 in sales in August of 2021 but you placed an order that same month to your supplier for $200,000.

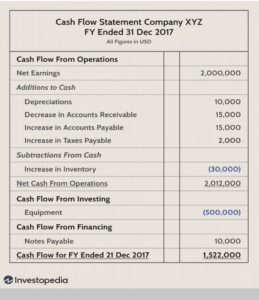

(investopedia has a great example here

Your cash P&L would show you had a loss of $50,000 for the month of August. For most, this seems normal and on the surface, it has logic behind. Cash in, cash out. It’s also very simple to calculate and starting out, we’re all looking for quick and easy solutions in our businesses. It’s perfectly fine if you never have intentions of selling or raising money from outside, getting a loan etc.

The problem is that a cash P&L does not use generally measured accounting principles. Which makes it harder to see true earning month or month and see a true TTM. (trailing twelve months). If you go to sell your business and a potential buyer cannot forecast what your business has done in the past or see a potential in the future, you’ll never get an offer.

The same issue will arise if you ever want a loan for your business. The creditor will typically take one look at your cash P&L and turn you away because they can’t see the real numbers in the past and you can’t show them the potential for the future. And even if you have no intention of selling your business or need to raise capital in the future, an accrual based P&L is important to use when it comes to understanding true profit and the ability to forecast it.

Example: If your business is growing at an exponential rate, you have to buy more inventory quickly right?

With a cash P&L, it might look like your business is in the negative that month you placed a big order. With an accrual P&L, it shows you are actually profitable based on your sales.

The ability to forecast profits and inventory management is critical to any ecommerce business, especially in a supply chain crisis as running out of inventory could put you out of business.”

A messy P&L will drive away the best opportunities.

An accrual based P&L calculates accounts receivable based on previous business activity in a given period. It takes the net value of sales by the average accounts receivable balance during the same period. This allows you to make calculations about how much cash is coming their way. In easier terms, the difference is simply the timing of when revenues & expenses are recorded.

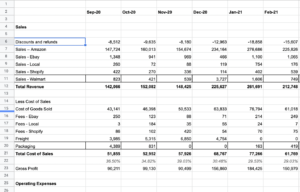

Look at line 7 and line 15 in the screenshot above. The COGS (cost of goods are subtracted each month based on sales) vs. all in one month when the order is placed.

A cash P&L records revenues & expenses when cash moves in and out while an accrual P&L spreads the expenses out (like inventory) based on the past months of revenue. This is critical to allowing a company to better determine their cash position in the present and provide insight into forecasting their business for the future.

Below is a link to download our accrual based P&L template.

Disclaimer: There is not a one size fits all approach to a P&L. Everyone will need to add or take away from this template and design it to fit your business best.

This template will point you in the right direction of creating a proper P&L for the future, whether you’re looking to sell your business this quarter or grow it for the next 20 years.